|

Russian Kid Deposit - Gold Royalty

Dasserat Township, Quebec (NTS 32D/03 - 04)

Article written by Mining MarketWatch Journal dated February 17, 2017 -

Thermal Fragmentation Mining Technology Ushers in New Era of Improved Economics for Underground Narrow Vein Miners Property The property is made up of 1 mining lease and 5 claim fractions which completely cover former Mining Lease 710 and totals 81 hectares in area.

Ownership

In 2005, Globex optioned its 100% interest in the property to Rocmec Resources Inc. (formerly Mirabel Resources Inc.). As a result of the agreement, Rocmec paid Globex $710,000 and 1,750,000 Rocmec shares. Additionally, Globex will receive a 5% Net Metal Royalty (NMR) for the first 25,000 oz of gold produced and a 3% with respect to all gold or other mineral production after 25,000 oz of gold production from the mine. Location The deposit is located on Lots 4 to 8, Range 7 and Lots 3 to 8 Range 8, Dasserat Township, Quebec. Access

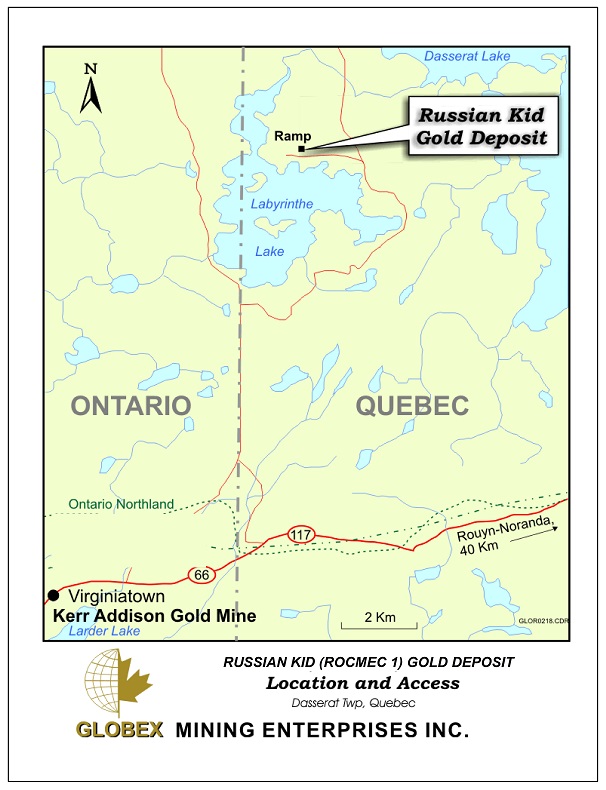

Access to the property is via an all season gravel road which leads northward from paved highway 117 near the Quebec-Ontario boundary. The gravel road follows the south and east sides of Lake Labyrinth directly to the mine site, a distance of approximately 16 km. Local Geology

The property is underlain principally by Archean rock units. The Keewatin volcanics strike roughly east-west, generally dip steeply to the south and are located on the north limb of the Dasserat Syncline. Many of the volcanic units are cut by various intrusive rocks. The gold mineralization on the Russian Kid property occurs principally in quartz and quartz-pyrite veins hosted by a shear zone which cuts across a quartz diorite. The quartz diorite outcrops intermittently along an ENE-WSW distance of approximately 7 miles (11.2 km) an The gold mineralization on the Russian Kid property occurs principally in quartz and quartz-pyrite veins hosted by a shear zone which cuts across a quartz diorite. The quartz diorite outcrops intermittently along an ENE-WSW distance of approximately 7 miles (11.2 km) and a width of 2,000 feet (610 m). The Russian Kid Gold Deposit consists of a series of narrow quartz-pyrite veins or quartz with semi massive pyrite bands in diorites which have been followed for approximately 4,000 feet (1,200 m) of strike length and to a maximum depth of 1,600 feet (488 m). The massive quartz diorite in the mineralized area varies in composition from granodiorite to quartz gabbro. The unit tends to be more acid to the south and more basic to the north. Gradual variations in grain textures and colours are observed within the unit. Thin section studies indicate two broad ranges of rock composition, granitic and mafic (diorite-gabbro). The more granitic phases are strongly sericite altered whereas the more mafic phases are variably altered principally by chlorite and to a lesser extent by epidote. Sulphide content is higher in the more mafic phases, probably due to the injection of sulphur rich hydrothermal solutions. The emplacement of the gold bearing quartz veins is structurally controlled by fractures in the quartz-diorite which acted as a conduit for hydrothermal solutions. The McDowell vein is thought to represent the principal fracture zone with a complex of subsidiary fractures on either side. Numerous other fracture zones traverse the main fracture zone. Displacements are generally small but can reach up to 100 feet (30 m) in some cases. History

The property was discovered in 1924 by A.W. Balzimer and Mike Mitto who performed surface exploration and trenching following the discovery of gold on surface. In 1934 to 1935, the first diamond drilling was carried out by Sylvanite Mines for a total of 3,646 ft (1,110 m). This was followed in 1945 by Erie Canadian Mines which drilled 10 holes. Bordulac Mines became the next owner and between November 1946 and September 1947 completed 13,802 ft (4,200 m) of diamond drilling which internal correspondence indicates had poor core recoveries said not to surpass 70%. Also in 1946, Hans Landbery delineated a diorite sill utilizing electromagnetic and magnetic surveys. H.S. Scott mapped the property and published a geological report. In 1948 and 1949, another 7,300 ft (2,225 m) of drilling was undertaken. In addition, a two compartment shaft was sunk to a depth of 150 ft (46 m), from which 1,010 ft (308 m) of development work was completed principally on the Talus Vein. Underground drilling totalling 2,100 ft (613 m) lead to the discovery of the McDowell Vein. As a consequence, the shaft was extended to 320 ft (95 m) and 1,620 ft (494 m) of drifting were developed principally on the 300 ft (90 m) level in the McDowell Vein. Work was suspended in 1952. During 1956 and 1957, electromagnetic surveys were completed east of the known mineralization. Between 1961 and 1963, 30 holes totalling 25,099 ft (7,650 m) were drilled under the direction of C.W. Archibald to verify the depth potential of the gold veins. A further 6,937 ft (2,114 m) were drilled in 1967 to check certain targets close to surface. Gold Hawk Exploration optioned the property in 1969 and drilled 10 holes. They purchased the property in 1972 and constructed a new access road. They also undertook an underground sampling program on the 300 ft (90 m) level. In 1972, Somed Mines optioned the property and started a ramp on the original Russian Kid discovery. The ramp eventually reached a length of 460 ft (140 m). Somed also reportedly carried out a reserve study. In 1978, El Coco Explorations Ltd. optioned the property and upgraded the access road to a year round gravel road. They installed infrastructure at the site including a machine shop, compressors and generators. A complete environmental study was undertaken by Beak in 1980. This was followed by the emplacement of surface infrastructure and metallurgical studies which showed excellent gold recoveries. Between 1979 and 1981 the ramp was extended to a total length of 2,672 ft (815 m) and a vertical depth of 425 ft (130 m). In addition, 1,490 ft (454 m) of drifts were excavated on the 150 ft (45 m) level, 662 ft (200 m) on the 300 ft (90 m) level and 660 ft (200 m) on the 425 ft (130 m) level. Six shrinkage stopes were also opened up on the 300 foot level. This work was completed in January 1982 coinciding with a significant fall in the price of gold. A total of 9,366 tons of material were sent to the Belmoral Mill in Val d'Or for test work. In 1983 Métalor undertook an exploration program on the property as part of a joint venture with El Coco. A total of 30 surface holes totalling 17,856 ft (5,442 m) were completed. In addition, 24 underground holes totalling 5,360 ft (1,633 m) were completed as well as the following development work. | Level 150 | Raises | 150 ft (46 m) | | Level 300 | Drifts

Galleries

Raises | 323 ft (98 m)

360 ft (110 m)

150 ft (45 m) | | Level 425 | Drifts

Galleries

Raises

Ramp | 777.5 ft (236 m)

384 ft (117 m)

314 ft (96 m)

100 ft (30 m) | | Total development work | 2,558.5 ft (780 m) |

In March 1984, Asselin, Benoit, Boucher, Ducharme, Lapointe, Inc. (ABBDL - TECSULT) completed a feasibility study on the property. The study concluded that the property had a total resource of 1,124,532 tons grading 0.247 oz/ton Au; an additional 200,000 tons in the Talus vein were classed as a geological resource. This report was prepared prior to the implementation of National Instrument 43-101 and is considered a historic resource. It has not been reviewed by a Qualified Person for Globex and should not be relied upon. In 1985, Dassen Gold Resources Ltd. acquired 90% interest in the property (Consolidated Gold Hawk Resource Inc. 10 %) and between November and December 1985 performed 13,434 ft (4,370 m) of drilling in order to investigate possible extensions of the gold-bearing horizons outlined in previous drilling. No further work was undertaken after 1986. Dassen became bankrupt on January 25, 2000 and KPMG Inc. was appointed receiver at the request of the Royal Bank of Canada, the petitioner. In late April 2003, Globex Mining Enterprises Inc. purchased 100% interest from the receiver KPMG Inc. Globex then optioned the property to Rocmec Mining Inc. (Rocmec) in 2005. Rocmec has dewatered the ramp and the first 2 levels, installed an underground mill and completed the mining of a first 44,000 metric tonne bulk sample. From 2006 to 2009 Rocmec extracted a total of 12,342 t of ore for a total of 1,111.65 oz of gold. Rocmec also completed 10,300 m of drilling both on surface and underground up to May 2010. Recent Work

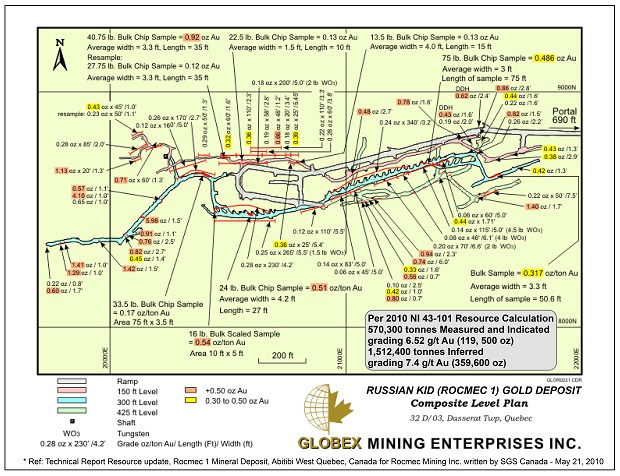

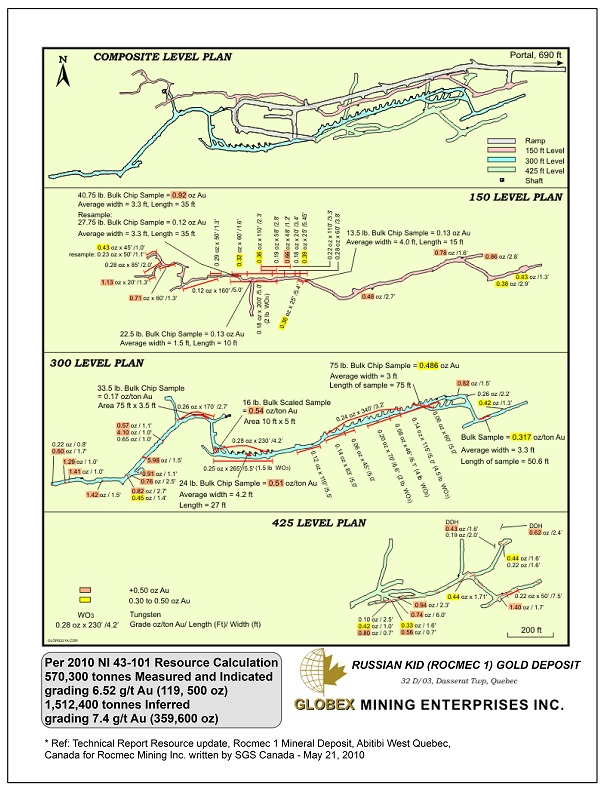

In April 2014, Rocmec announced that the Company obtained authorization to change its name and ticker symbol. The company's name changed from Rocmec Mining Corporation Inc. to Nippon Dragon Resources Inc. ("Nippon") and obtained the new ticker symbol "NIP". The company restated its growth strategy to include the commercialisation and employment of its proprietary thermal fragmentation technology in additional to its mineral property development. The most recent NI 43-101 resource calculation by Rocmec was released on May 10 th, 2010 and is available on Nippon's website as well as on SEDAR. The reader is referred to Nippon's disclosure of the report to review full details of the resource estimate. The report states that Russian Kid resources; - Measured and Indicated Resources stand at 570,300 t grading 6.52 gpt Au for a total of 119,500 oz and;

- Inferred Resources stand at 1,512,400 t grading 7.40 gpt Au for a total of 359,600 oz.

Classified Global Resources at 3 g/t Au Cut⅕Roff | Classification | Tonnage | Au

(gpt) | Oz

(31.103 g) | Average

Thickness (m) | Volume

(m3) | Surface

(m2) | Measured | 124 800 | 6.95 | 27 900 | 0.77 | 46 200 | 60 300 | Indicated | 445 400 | 6.40 | 91 600 | 0.65 | 165 000 | 255 000 | Total | 570 300 | 6.52 | 119 500 | 0.67 | 211 200 | 315 300 | Inferred | 1 512 400 | 7.40 | 359 600 | 0.75 | 560 100 | 749 900 | Classified Global Resources at 6 g/t Au Cut⅕Roff | Classification | Tonnage | Au

(gpt) | Oz

(31.103 g) | Average

Thickness (m) | Volume

(m3) | Surface

(m2) | Measured | 63 800 | 9.21 | 18 900 | 0.79 | 23 600 | 29 700 | Indicated | 171 200 | 9.64 | 53 100 | 0.62 | 63 400 | 101 500 | Total | 235 000 | 9.53 | 72 000 | 0.66 | 87 000 | 131 200 | Inferred | 762 300 | 10.31 | 252 600 | 0.71 | 282 300 | 399 500 |

Ref: Technical Report Resource update, Rocmec 1 Mineral Deposit, Abitibi West Quebec, Canada for Rocmec Mining Inc. written by SGS Canada - May 21, 2010 As of November 2010 all underground and surface installations and equipment have been removed from the property and the ramp has been sealed. Rocmec has focused mainly on its fragmentation technology since that time. In January, 2013 Rocmec announced the results of sampling and geophysical surveys (MAG) conducted by Geodem. Highlights of the project included study of the Boucher Zone which interpreted a reasonably precise projection of the trace of the zone at surface which was found to correlate well with the previously mapped Lake Labyrinth Fault. Analysis of previous geological reports confirms that the Labyrinth Lake Fault has been recognized over a distance of 4.5 km extending across ground held by Rocmec. Outcrops on the shore of Labyrinth Lake expose the volcanic rocks on the footwall of a gabbroic intrusion (hanging wall) but the Boucher zone itself does not outcrop. The contact is well defined by Magnetic survey. The Boucher Zone can now be related to a regional structure that has received little exploration in the past that offers good potential for further exploration, both in the immediate area of the mineralised zones already identified, as well along the extensive trace of the Labyrinth Lake Fault. No Underground work has been reported on the property since 2013.

|